Facts About Hsmb Advisory Llc Revealed

Facts About Hsmb Advisory Llc Revealed

Blog Article

Hsmb Advisory Llc - Questions

Table of ContentsHsmb Advisory Llc Fundamentals ExplainedAn Unbiased View of Hsmb Advisory LlcHsmb Advisory Llc Can Be Fun For AnyoneThe Hsmb Advisory Llc IdeasThe 2-Minute Rule for Hsmb Advisory LlcTop Guidelines Of Hsmb Advisory Llc

Ford says to stay away from "cash money worth or permanent" life insurance policy, which is even more of an investment than an insurance coverage. "Those are really complicated, featured high payments, and 9 out of 10 people do not need them. They're oversold due to the fact that insurance coverage agents make the largest commissions on these," he says.

Impairment insurance coverage can be expensive. And for those that choose for long-term treatment insurance, this plan might make impairment insurance policy unnecessary.

The smart Trick of Hsmb Advisory Llc That Nobody is Talking About

If you have a chronic health problem, this kind of insurance coverage can wind up being essential (Life Insurance St Petersburg, FL). Don't let it stress you or your bank account early in lifeit's normally best to take out a plan in your 50s or 60s with the expectancy that you will not be utilizing it till your 70s or later.

If you're a small-business owner, take into consideration shielding your resources by acquiring organization insurance policy. In the occasion of a disaster-related closure or period of rebuilding, organization insurance coverage can cover your earnings loss. Consider if a substantial climate occasion impacted your shop or production facilityhow would that impact your revenue?

And also, utilizing insurance coverage could sometimes set you back greater than it saves over time. If you obtain a chip in your windshield, you might take into consideration covering the repair service expenditure with your emergency cost savings instead of your car insurance coverage. Why? Due to the fact that using your car insurance policy can trigger your regular monthly costs to rise.

All About Hsmb Advisory Llc

Share these ideas to secure liked ones from being both underinsured and overinsuredand seek advice from a relied on expert when needed. (https://www.flickr.com/people/200147121@N02/)

Insurance that is bought by an individual for single-person insurance coverage or insurance coverage of a family members. The private pays the costs, instead of employer-based health and wellness insurance policy where the company often pays a share of the costs. People may buy and purchase insurance from any kind of plans available in the individual's geographical region.

Individuals and families might receive financial aid to decrease the price of insurance coverage costs and out-of-pocket expenses, however just when registering with Connect for Wellness Colorado. If you experience particular modifications in your life,, you are eligible for a 60-day amount of time where you can register in a specific plan, even if it is beyond the annual open registration period of Nov.

Hsmb Advisory Llc - Truths

- Connect for Health And Wellness Colorado has a full checklist of these Qualifying Life Occasions. Dependent kids that are under age 26 are qualified to be included as family participants under a parent's coverage.

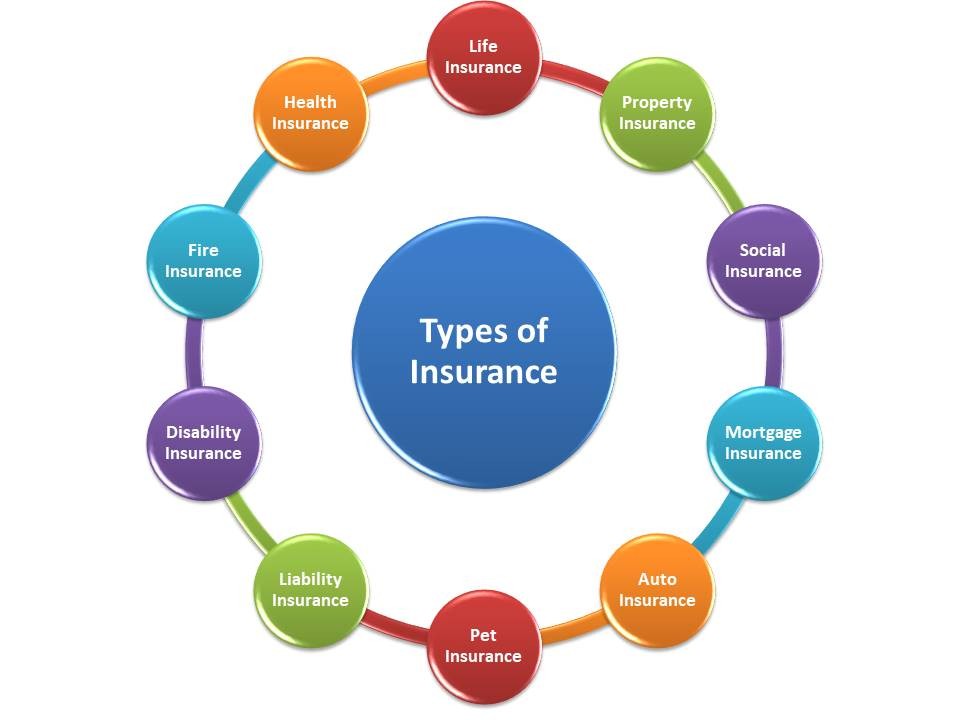

It might seem visit straightforward however understanding insurance policy kinds can also be puzzling. Much of this confusion comes from the insurance policy sector's recurring objective to develop tailored coverage for insurance holders. In designing versatile policies, there are a range to pick fromand every one of those insurance policy kinds can make it tough to recognize what a specific policy is and does.The Best Guide To Hsmb Advisory Llc

If you die throughout this period, the individual or individuals you have actually named as recipients might obtain the cash payment of the policy.

However, many term life insurance policy plans let you convert them to an entire life insurance policy plan, so you do not lose insurance coverage. Usually, term life insurance policy policy premium payments (what you pay per month or year into your policy) are not secured at the time of purchase, so every five or 10 years you own the policy, your premiums might rise.

They likewise often tend to be less costly total than whole life, unless you acquire an entire life insurance policy plan when you're young. There are additionally a couple of variations on term life insurance policy. One, called group term life insurance policy, is common among insurance policy choices you may have accessibility to through your company.See This Report about Hsmb Advisory Llc

This is typically done at no cost to the staff member, with the capacity to buy extra insurance coverage that's obtained of the employee's income. An additional variant that you might have accessibility to with your employer is supplemental life insurance policy (Life Insurance St Petersburg, FL). Supplemental life insurance policy could include unexpected fatality and dismemberment (AD&D) insurance coverage, or interment insuranceadditional insurance coverage that might help your family members in case something unanticipated occurs to you.

Permanent life insurance coverage merely refers to any type of life insurance plan that does not end.

Report this page